After speaking to 2000LPs = Emerging Manager / LP Fit

How to make sure that the value , stage, & goals are a fit on both sides

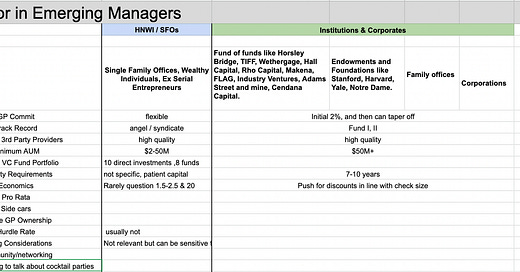

The LP / Allocator universe can be quite overwhelming to unpack, and many emerging managers who are starting their journey are trying to figure out where to start when it comes to targeting the right LPs. The curation, thoughtfulness, and correct alignment can assist in ensuring that there is a Fund / LP fit. Most likely emerging VCs will be focusing on HNWI , Angels, and Single Family Offices as ideal LPs. However, Institutional LPs would be good to still keep on your radar to build relationships with as many of the institutions work closely with fund of funds. The fund of funds are essentially the accelerators for GPs, and Institutional LPs essentially refer to it as graduating from the FOF class. The funds that do really well can eventually get their own mandate which means that the institutions could eventually directly invest in the new manager, but this often occurs over various cycles and references.

Understand Goals

With any allocator, it is important to understand what their goals are and what they are trying to achieve. We validated that it’s really the SFOs and HNWIs who are best for micro and emerging VCs after speaking to one of our LP friends (SFO) who reached out to more than 2000 institutional LPs.

“Yes, I can confirm this. I'm helping a first-time-fund that is raising a smaller initial fund get LP capital. To test some assumptions we reached out to more than 2000 institutional LPs, e.g. public pension, endowments, foundations, FoF, etc. We also hit upon some of their advisors, e.g. RIAs like NEPC and Cambridge Associates. We did this both in U.S. and abroad.

Some said they were already fully allocated to venture, while most said the fund size was just too small. We'll keep the relationship for Fund II.

SFOs/HNW are the way to go, but one interesting third way option are mission-aligned corporate firms that allocate. E.g. if you're an insurtech fund Axa Advisors may allocate in addition to their own direct investing.

Hope this helps.”

Anonymous Private LP (SFO)

To help further, we are reaching out to some GP friends like David Teten & some LPs who are supporting us in our emerging manager accelerator. This is still in the works, but feel free to contribute if you have any insights here: https://docs.google.com/spreadsheets/d/159ZVi_0NXopdqRcaJtGjL2XiMDr_Kdf3_V2iKjbdwKk/edit#gid=0

This is a pretty interesting breakout of how Next Gen Family offices are splitting up their time. As you can see, 33% is being considered for VC investment activity.

On average, according to SVB , 10% of their overall portfolio is allocated to VC. Its normally around 10 direct investments and 8 funds , and right below is a great overview of their portfolio asset allocation.

Below is also a great breakout as you can see of how they are distributing across direct funds, Fund of Funds, Coinvestments within their funds or other families, and minority/majority stakes

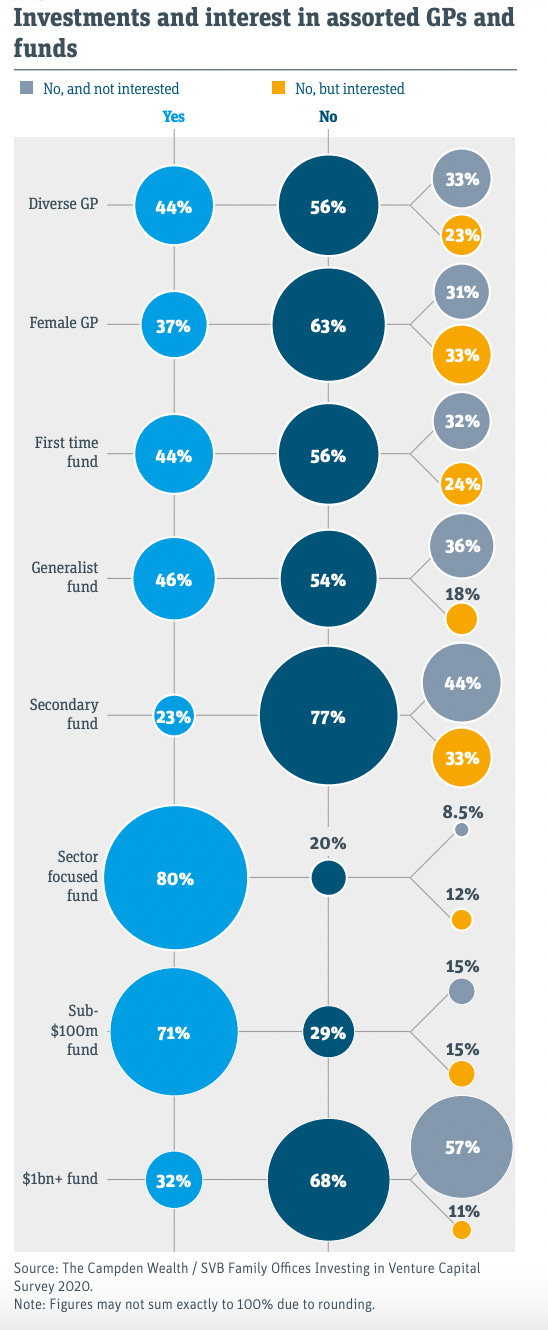

This is a great visual depiction of volume, direct allocations to funds, directs, & assorted GPs.

Further reading: