Investment Thesis on the Future of Embedded Finance

Author: Shuyej Uddin (Venture Capital Fellow at Sutton Capital)

The past three technological waves were the internet, cloud computing and mobile phones. The next technological wave seems to be the emergence of Embedded Finance. You probably heard of FinTech? The next paragraph talks through Fintech, and introduces the concept of Embedded Finance.

FinTech is probably one of the most talked-about topics, since 2015, and growing in popularity since 2020. FinTech refers to the offering of financial services to the wider public, through technological means including online saving. FinTech has evolved into Embedded Fintech which focuses on offering financial services to financial institutions. What is Embedded Fintech? This is the offering of financial services to banks. These include cryptocurrency investing, data management and bill negotiation services. What is more recently a growing field of interest is Embedded Finance. Embedded finance is the offering of financial services by non-financial companies. The difference between Embedded Finance and Embedded Fintech, the former is financial services offered by non-financial institutions to the public, and the latter is focused on offering fintech solutions, as a tool to the decision making of financial institutions. Given the distinguished difference between the two, and that embedded FinTech is a category of Embedded Finance, in other words, referred to as Embedded Banking in this thesis, we motivate the thesis to focus on Embedded Finance.

Next, the Embedded Finance Industry is important to analyse as we can note the following. The market is estimated to potentially be worth $7 trillion. Figure 1 demonstrates in which aspects the industry is expected to grow the most with payments being the area of Embedded Finance growing the most, by approximately 774.5% rounded to one decimal place. More of each aspect of Embedded Finance will be explained later in the report. Figure 2 suggests technology companies offering financial services will dominate finance, one reason is due to customisation of services. This is related to trends, and in the ‘Current Trends in Embedded Finance' of the paper, we explain how the customisation of financial services is supporting the growth of Embedded Finance - see ‘customer demand for integrated services’ section. What we can learn is that the field of Embedded Finance is a growing field, therefore we next analyse the topic of Embedded Finance.

Figure 1: Forecasted Market Value of Embedded Finance

Source: Emarketer

Figure 2: Role of Technology companies in financial services

Source: Emarketer

Given that we have motivated the topic of embedded finance, the factors such as payments that define embedded finance, and current trends, these topics, are what defines embedded finance, and its future, we next explain what is Embedded Finance, the problems Embedded Finance solves, and the factors defining Embedded Finance, the market size, recent IPOs before delving into our main point of discussion, the future of Embedded Finance.

What is Embedded Finance?

We now formally define Embedded Finance, as the introduction was an informal definition of Embedded Finance. Embedded finance is the role of financial services being offered by non-banks through software and application. What this has allowed is the increase in usage of financial services, offered by technology companies, to consumers and businesses. Fintech companies have evolved embedded finance to offer banking as a service platform.

A better way to understand Embedded Finance is to analyse the main players. So, who are the main players in the market, to date? According to International Banker, citing Lightyear Capital, the three main players are providers, enablers and containers, all of whom are supporting the industry growth. Providers are services utilising financial services in their platform to increase distribution of existing products or services and increase customer retention i.e. companies including Wealthsimple. Enablers are firms that support data infrastructure and connectivity through API and Baas - Banking as a service platform. I.e. companies including Green Dot. The last main players are containers, firms offering platforms that aggregate financial services across providers i.e. companies including Shopify. Now that we know what Embedded Finance is, and the main players, we next analyse the problems Embedded Finance solves.

What problems does Embedded Finance solve?

First, the main problem is supporting the digitalisation of financial services. With declining economic profit by top global top banks and insurance companies, which had decreased by $800 billion and $300 billion, from 2015 to 2018, the figures are worsening due to the impact of Covid-19. The economic profit is worthwhile to mention, as it measures the efficiency of resource allocation. What this suggests is banks are not being efficient with their resources, and there is a need for innovation. Even though banks have developed digitalisation of services, there is a need for digital business models. To have a better understanding of business models, have a read of this article, we will not delve into business models in order to stay focused on the main point of the thesis, that is why the market is worthwhile to invest towards.

Second, Embedded Finance helps solve existing problems within banks. Since, the 2008 crisis, banks have had increased regulation, and in the UK where financial services are the leading industry in economic productivity, the impact of Brexit has also led to regulatory challenges. In other words, regulation and loss of customer trust have been an issue. Other problems include, changing interest rates, digitalisation of financial services. Note that even though digitalisation of financial services is linked to problems within banks, we initially referred to the problem as a distinct topic, since the problem is a significant problem, already in the industry. Nevertheless, Embedded Finance can help solve banking problems, to help banks adapt to the new world of changing relationships (thus regulation), credit-based economy, and digitalisation of services. The most important aspect of Embedded Finance is that clients are the heart of the activity, and what this means is improving client relationships, therefore trust, with banks.

Third, Embedded Finance helps solve existing problems related to attracting clients. Many clients may not be able to purchase products or services due to financial constraints, and further constraints are imposed when banks are reluctant to offer financing opportunities. As a result, businesses lose out on potential clients (or customers). Embedded Finance allows businesses to offer financial services, thus attracting more potential customers. One example to note is Apple Card, which was a collaboration between Apple and Goldman Sachs. We will refer to more businesses offering Embedded Finance, later in this thesis, but we note the example to help readers better understand what we are referring to.

Overall, the problem Embedded Finance solves, is it helps create value. Through digitalisation, and improvement in banking services, and clients being able to purchase items such as mortgages which they wouldn’t be able to purchase due to risk, it creates a market that allows clients to be the heart of all activity. Through Embedded Finance, many industries can benefit which we explain while referring to the current Embedded Finance market. Therefore, next, we categorise Embedded Finance and then analyse the current Embedded Finance market.

Factors Categorizing Embedded Finance:

There are five factors categorising Embedded Finance, see below. These factors will help us understand the overall market analysis. The factors have been provided by Finextra, except we believe Embedded Payments and Embedded Card Payments are linked and can be thought of as one factor of Embedded Finance rather than being separately defined as seen in Finextra’s article. Next, we define each of the factors of Embedded Finance.

1. Embedded Payments

Embedded Payments is the offering of payment facilities, within an existing business software. This means there is no need for separate software, i.e. banking account, for payments.

2. Embedded Lending

Embedded Lending relates to the fact consumers can attain a loan at a given point in time, rather than applying for a loan through a bank.

3. Embedded Investments

Embedded Investment enables non-financial institutions and consumers by simplifying the investment process, and improving the distribution of investment products.

4. Embedded Insurance

Embedded Insurance is protection included from the purchase of a product or service.

5. Embedded Banking

Embedded Banking enables the use of data to support loyalty payment to increase customer retention or analyse customer spending behaviour, online loans, mobile bank account offering, debit cards, and payment services. It helps non-banks offer banking services without the need for a banking license.

Market Size

Embedded Finance has grown in popularity, particularly due to Embedded Banking. Fintech companies have adopted and supported the growth of Embedded Banking, thereby supporting the growth of the Embedded Finance Industry too. Fintech companies have increased the growth of Embedded Banking as it helps solve frictions in financial markets, in other words supporting financial transactions. So, as FinTech operations continue to grow due to reasons including more innovation, strategic partnership with other Fintechs or even banks, then we should expect the Embedded Finance Industry as a whole to benefit, and grow too. This is further backed by the fact, Banks and Credit Unions are key to the growth of Embedded Finance. However, Embedded Finance has more than one factor that can categorise the industry as noted earlier. For instance, Embedded Lending has become popular too, as it helps ordinary businesses support clients financially when they purchase a product or service, solving frictions in markets. Nevertheless, Embedded Finance solves problems as explained in the ‘What problems does Embedded Finance solve’ section, which are other reasons why the industry will grow. So, there is scope for industry growth, and we need to investigate to understand the market value. Therefore, in this section of the thesis we talk about the Market, to then motivate IPOs in the industry.

Next, we begin with industry statistics. It is forecasted that Embedded Finance companies will grow by five times their current market value, with a future market estimated to be worth $250 billion. Other reports suggest in the US alone the market could generate $230 billion in US alone, and $7.2 trillion globally, by 2030. The industry will grow as it has become normal for technology companies to offer financial services, and helpful for companies with digitised products and services. What makes the industry unique, is that SMEs can benefit from Embedded Finance. Digital payments are accelerating due to QR code scanning, and the buy now pay later option is further increasing business sales, thus interaction with clients, so Embedded Finance is crucial to support transactions. With growing consumer transactions, i.e. for Amazon, their total consumer spending tripled from 2014 to 2018, plays a greater role of Embedded Finance to help businesses. Next, we look at the digital market, to understand why businesses need to adopt Embedded Finance to their business models.

Since the pandemic, the digital industry has changed. We will next see that e-commerce has grown, but to some extent, Embedded Finance has played a role in e-commerce growth. Embedded Finance supports MSME, B2C and B2B companies to increase customer retention, monetize customer base and vertically grow their existing, and offer new and relevant products. Moving forward, for instance, in e-commerce the global retail trade increased by 21.4%, rounded to one decimal place. Some of the reasons for the trend can be attributed to the fact that in April 2020, 30% of consumers increased mobile usage of mobile banking apps, and 35% were using online banking more. This meant that online banking and online services were much more frequently used to pay for transactions such as e-commerce, and services have become digitalised. So, if we delve deeper, focusing on non - European markets, to provide a less biased view of the digitalisation of services, we report that Latin America’s online market place Mercado Libre sold double items in a given day, in quarter two of 2020, compared to 2019. In Africa, the e-commerce platform Jumia reported an increase of 50% in transactions, from January 2020 to June 2020. As for China, we report that the online share of retail sales grew by 26.8% from August 2019 to August 2020. These figures have been reported by this article, which later argues the trend in e-commerce is likely to be sustainable, which is further backed by a report, that argues the partnership of national and international stakeholders, to support e-commerce development and fairer e-trade policies to support least developing countries to grow digitally. Fairer e-trade policies, and a regulated e-commerce market, means that digitalisation of services can be progressive. So, it is clear digitised services is the new norm, and businesses need to adapt to fully benefit from additional data to offer better products and services and be able to finance the scaling of services and monetize the customer base for which Embedded Finance can be of aid, to fully take advantage of the digital market. With the increasing importance of fairer digitalisation of services and the role of Embedded Finance, we next look at the role of governments in the Embedded Finance market.

In order to understand the role of governments to support of Embedded Finance, we break things down into geographical continents. According to Fintechfutures, the pandemic has supported the growth of governments in partnership with regulators have supported the industry growth. We begin with Asia, wherein Singapore the government supported an $87.8 million fintech care package, which includes a ‘Digital Acceleration Grant’ to support fintech in investing more towards their digital products. China has called for banks to lend more aggressively to small businesses, with the People’s Bank of China cutting interest rates by at least 51%. As mentioned earlier, Embedded Finance reduces the risk of lending, so this move can support Embedded Finance activity. North America, in the United States (US), has injected approximately $2.3 trillion into various lending programs, although not specified in fintech, it can be suggested that as an aspect of Embedded Finance is Embedded Lending, this investment can support Embedded Finance, therefore. Australasia, particularly Australia, has seen the investment of an $11.21 billion Structured Finance Support Fund, to support funding markets hit by Covid, although not specified but can be suggested the fund can support Embedded Finance, as it is a funding market. Europe, particularly the UK, had created a three-month freeze on loan and credit card debt, meaning lending has lower risk, which means Embedded Lending, although not specified, and one can suggest, Embedded lending can benefit from this change. Much of the global bank initiative is not directly there to support Embedded Finance explicitly, but one can decide implicitly that government actions will support Embedded Finance. Most government actions explained, support better payment, lending, and banking activities, as an example, and Embedded Finance is already there to support such activities and can be utilised to support government plans and proposals to at least improve financial services, and recover quickly from the pandemic.

Much of the role of governments has been to support financial services, to support faster economic recovery from the pandemic. We mentioned that governments investment towards financial services has increased the growth of Embedded Finance, in the last paragraph. We have evidence to confirm our conclusion. Modular Bank, have confirmed Covid has increased the urgency of digital banking transformation, to reshape financial services, and in fact, due to Covid - the UK government, have plans in place to accelerate Embedded Finance to reshape financial services. Interlinking the two points from the two paragraphs, government support of financial services can therefore accelerate digital banking service or Embedded Banking, leading to the growth of Embedded Finance. So, does digital transformation look increasingly possible to be the new future? Citing McKinsey, Modular Bank confirms no more than 85%, which is more than 50%, including those 65 plus, prefer digitalisation of everyday transactions, which can be suggested to include digital banking. The pandemic was supported by the fact relief funds were easily transferred due to Embedded Payments. Overall this means more integration of Embedded Banking, and also Embedded Payments, to support the new digitalisation of service. Therefore, government actions are indirectly and directly, supporting Embedded Finance.

The role of governments supporting financial services, in particular, Embedded Finance will be further explained in this last paragraph. In 2010, the UK and European policymakers, for instance, created regulations to ensure banks open data and services to third parties to support financial innovation, to offer better products to consumers - leading to Fintech. In fact, the European Commission has a Digital Finance Strategy, to support the development of Embedded Finance, but compared to the UK, they are slightly behind. Nevertheless, initiatives are being taken such as the ‘InvestEU’ program, to support the transition to Digital Finance. Next, during the pandemic, government schemes as mentioned earlier, two paragraphs before, focused on supporting banks, since banks have large client bases, more efficient with product offering, and banks abide by the regulation. Embedded Finance, only further improves client interaction with their banks and meeting regulatory demands, so governments are likely to support initiatives that improve financial services, particularly through banks, which only means Embedded Banking is likely to further grow. The initiative in 2010, further confirms that governments prefer Fintech innovations, or Embedded Banking, or even the UK Government announcing the £1 billion investment to support Fintech. So, through a better environment for financial services, particularly for banks, what this means is an economic benefit, and a better Embedded Finance environment will in the future support the real economy, for which digitalisation is essential. Through benefiting the real economy, governments are strongly in support of Embedded Finance. The UK government, the second largest leaders globally in Fintech, are proof Embedded Finance has a strong value for the economy, as they support Embedded Banking through Fintech funding.

From the last three paragraphs, we can conclude the industry has strong potential for growth, and the estimate of $7.2 trillion of the industry’s global value in 10 years seems realistic, particularly due to government support. However, to provide a non-biased view, we need to consider India. Discussing the UK motivates the argument Embedded Finance has a strong value in developed economies and growth in developed economies. We now consider the case for developing economies, to see how they can benefit from Embedded Finance, focusing on the Indian economy. We focus on India, due to being the second largest unbanked population in the world, so there is more data to suggest if Embedded Finance is really useful, and due to the fact India’s have low levels of financial literacy. Can Embedded Finance solve frictions in financial markets? Fintech can solve inefficiency caused by financial literacy and the high cost of conventional banking. Fintech can offer a better customer experience due to the right financial product being offered to consumers, and improve banking and client relationships. This is one of the reasons 59% of Indians, considered opting for a digital-only bank, which was before Covid, and since Covid, digitalisation of banks is in greater demand. We can suggest that Embedded Banking is increasing in popularity in India, thus Embedded Finance. However, we are interested in government views, which we will explain next.

Digital banking supports financing better since it solves the current insurance and credit issues, which makes banking difficult in India, which has motivated governments to support the initiative. Another reason the Indian government can support Embedded Finance is that it creates, and supports markets, that in the past were difficult to develop by traditional banks or financial organisations, due to cost and limited data. So, with market failure becoming less of an issue, thus economic growth, the Indian Government will further support Embedded Finance. We can draw from this, that Embedded Finance is likely to grow in popularity in other developing economies, as the case for India, which is a country with a huge population and a key developing country, suggests there is greater benefit in Embedded Finance. So, we covered that the figure of $7.2 trillion is realistic and that governments are supporting the growth of the industry, in both developed and developing countries. Next, we focus on recent IPOs to fully comprehend the value of the market based on start-ups.

Venture Capital Raising and IPOs:

There has been a substantial amount of venture funding in the industry. We next look at a few examples from pymnts. For Embedded Payments, we can note the following examples. SalesTrip, a UK firm, raised $1.4 million, due to the fact the company offers software to manage travel and expenses, which is particularly important due to Covid. Qolo, a US company, raised $3.8 million for its payment processing service. BukuKas raised $10 million to launch a digital bank for small businesses. For Embedded Lending, we can note the following examples. MicroLEAP, a Malayisan company, raised $3.3 million to develop a B2B technology that offers lending facilities, to help small businesses raise shariah-compliant funds; businesses who struggle to raise funds from traditional methods. A German company, Banxware, offering Embedded Lending, raised €4 million. For Embedded Banking we can note the following examples. Although not specified which service will be developed, Jumbotail, an Indian firm, raised $14.2 million to help expand its geographic markets. The firm is an e-commerce technology platform, and as we noted earlier in the thesis, e-commerce relies on Embedded Finance, so we should expect Jumbotail, in a very likely scenario, to invest in Embedded Finance services too. Jedox, a German company, designed a technology that considers financial planning and analytics and raised more than $100 million. Rapyd, a UK and US company, facilitates embedded FinTech into third-party applications through API, to help payment processing, raised £300 million. There has been a substantial amount of venture funding, whether in the Americas, Europe or Asia, and we can not Embedded Finance, in the form of more commonly Embedded Lending, Embedded Banking and Embedded Payments, becoming the most common source.

As well as understanding venture funding in Embedded Finance, we need to understand which companies are integrating Embedded Finance. We analyse the big technology companies to understand this notion. So, Amazon, Shopify and Uber are working towards Fintech solutions to help improve their services. What this new initiative will support is checking accounts, insurance or loans. Uber announcing their Embedded Payment platform, UberMoney, is one example of adopting Embedded Finance. Other companies which have enabled Embedded Finance are Stripe, with their announcement to have banking as a service API to enable financial services into their marketplace or platform. Google developed a banking and payment platform, and Airbnb, DoorDash, Affirm, all added financial services to their services. Not only are major companies adding financial services, but many companies are also offering financial services such as Stripe. See Figure 3. So not only is there venture funding happening to support the Embedded Finance industry, but big technology companies are adding Embedded Finance to their system, and platforms are being developed such as Stripe or Rapyd, to support Financial Services being offered.

Figure 3: Companies that help Financial Services to be offered

Source: Techcrunch

Next, we focus on the IPOs in the industry. Marqeta, a US company that supports fintechs, financial institutions and brands that include e-commerce companies, to embed financial services to their client’s activity, announced an IPO worth over $1.2 billion. Another company focused on Ant Group, a Chinese company that helps e-commerce and other businesses with Embedded Payments, and Embedded Lending, is set to raise the most expensive IPO in the world, worth $35 billion. These are a few notable IPOs that have occurred in the industry, however SPACs have become more common in the industry. For instance US fintech firm, Affirm, is seeking a $10 billion IPO, but is looking to raise the fund through SPACs. So, we delve into SPACs next in this thesis. However, from this paragraph, one thing to learn is many of the IPOs in the Embedded Finance industry have occurred in the form of Embedded Banking, due to Fintech companies going public.

SPACs are special purpose acquisition companies that create IPOs through mergers with private companies. It is a special type of IPO. Fintech SPACs allow private firms with rising demand for banking solutions, driven by the impact of Covid, to solve their banking issues. Recent SPACs in Fintech include FinTech Acquisition Corp raising $250 million in IPO funding, Foley Trasimene Acquisition Corp. || raising $1.4 billion in IPO funding, SVF Investment Corp raising $525 million in IPO funding, and Dragoneer Growth Opportunities Corp raising $690 million in IPO funding. Other SPACs worth noting are Diginex’s merger with 8i Enterprises Acquisition Corp, where the former focuses on crypto and blockchain solutions. Sofi which is an Embedded Lending platform, is going public through a SPAC worth $8.65 billion. Payoneer, which is an Embedded Payment company, is going public with acquisition with FTAC Olympus Acquisition Corp, a deal worth $3.3 billion. Unlike traditional IPOs, which have commonly seen the growth of Embedded Banking, from the aspect of SPACs, there has been more growth in Embedded Lending, Embedded Payment and Embedded Banking. Note for further analysis of FinTech SPACs, see figure 4. Although we will not discuss SPACs any further, the article is recommended to have a much broader understanding of SPACs within Embedded Finance.

Figure 4: FInTech SPACs between Q1 2020 to Q1 2021

Source: FinTechNews

So, we can note that the Embedded Finance Market has strong growth potential, and that venture funding raised a substantial amount, and recent IPOs including SPACs prove the companies integrating Embedded Finance into their service can financially benefit, and it can support their recovery from the challenges of Covid. Which industries can benefit from Embedded Finance? What does the future hold for Embedded Finance? We delve deeper into this aspect next.

Industries Benefiting from Embedded Finance:

As we noted, there are six factors categorising Embedded Finance, see below. To be able to understand which industries can benefit from Embedded Finance, we analyse benefits from the perspective of Embedded Finance categories, beginning with Embedded Payments and finishing the analysis with Embedded Banking. However, all industries can benefit from Embedded Finance, depending on the type of Embedded Finance they choose to utilise to support their business model, but also their transition to the digital world.

1. Embedded Payments

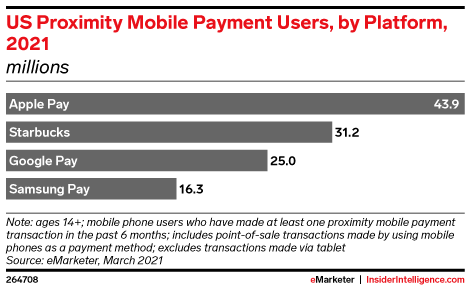

Kobalt, has created a centralised platform to help music artists access their payments, but data with APIs linking to Spotify, Apple and YouTube. This cash flow is important for artists to help survive financially in the industry. The music industry, or any individual working self-employed in industries, can benefit from Embedded Payment systems. Uber and Lyft, have created a payment processing system that allows users to pay for transactions, once completing a ride, rather than using their credit or debit card. Their reason for the initiative is to encourage car travel services, and ensure customers feel comfortable and pain-free from travel services. What this means is transportation services can benefit from Embedded Finance. E-commerce businesses can benefit from monetized payments. This means any business operating in e-commerce platforms can benefit from Embedded Payments. This notion can be further supported by the fact Shopify, being the first e-commerce platform, to accept payments from VISA, MasterCard and others, ensuring consumers avoid third party fees. One last point, is that as seen in figure 5, Embedded Payments can benefit any industry as Apple Pay or even Google Pay, are easier means of purchasing products and services.

Figure 5: Popularity of Mobile Payments

Source: Verified Payments

2. Embedded Lending

Klarna and Afterpay, are notable examples of Embedded Lending. Their programs allow consumers to distribute payments to several monthly smaller instalments, making lending and purchasing much more affordable. What this means is that Retail Companies, or even Restaurant Services, can benefit from more revenue at least, as consumers find buying much cheaper, and accessible, at least financially, which is a big factor in creating frictions within markets. Amazon’s ‘buy now, pay later’ option means transactions are converted to a loan, as consumers owe Amazon for buying a product, which they can pay back in their own time. This means any business, for any industry, can benefit from Amazon’s initiative. The Educational Sector can benefit from technology to understand if students will end up borrowing money more than what they can afford and at what capacity. The Agricultural Industry relies on loans to finance agricultural operations, and with Embedded Lending farmers can be offered more customised lending, to help better manage their agricultural process. Other Embedded Lending innovations that can help any industry includes Capify to focus on loans and revenue-based finance, and Iwoca that focuses on SME loans through their Open Lending platform. In Europe, Open Banking is supporting access of challenger banks and Fintechs to partner with mortgage or gas providers, to offer cheaper services. Overall, this means Open Banking can support any industries growth, through a partnership with challenger banks or Fintechs.

3. Embedded Investments

Spark Change, provides a technology platform and financial product ecosystem, for institutional and individual investors who seek exposure to physical carbon allowances. So, this means the Energy Sector, and companies operating in this industry, in the stock exchange, can benefit from financing solutions. Another platform, taking its toll in the Investment Industry, is Acorns. The organisation supports investing, through seamless and touch-free investment, where the portfolio is adjusted based on market activity. This means users do not have to pay attention to stock or mutual fund values. Investing is stressful, and constantly analysing market movement is a hindrance to encouraging investment, and removing this barrier is likely to encourage more retail investors, or even corporate investors to invest. As a result, the Financial Industry will grow, explicitly at least, however, any industry operating on the stock exchange will benefit too.

4. Embedded Insurance

Unlike all other five topics categorising Embedded Finance, the least talked about the topic can be accredited to Embedded Insurance. However, there have been initiatives that support the growth of Embedded Insurance, with TESLA, offering insurance programs to purchase the appropriate amount of coverage at an instant rate. What this means is firms offering expensive cars, so the Automotive Industry can benefit from Embedded Insurance. Transportation services, such as Uber, benefit from Embedded Insurance through offering insurance policies, which will encourage more users to use transport services, only meaning the Transport Industry will grow further through Embedded Finance. The real Estate Industry, can benefit from insurance policies to protect their homes, which will further encourage demand for homes, leading to higher home prices and overall growth in the industry.

5. Embedded Banking

DICE, support music artists with touring decisions. With their large data set, they ensure with their innovative technology, better pricing and timing decision to avoid conflict with other artists. Therefore, the music industry can benefit from Embedded Banking, through extensive data to help with financial decisions. Seldon supports modelling of drug testing for pharmaceutical benefits, where solutions are built faster, and properties are predicted much accurately without having to perform tests physically in labs. We categorise this as Embedded Banking as it is related to data usage to help improve Healthcare business operation, and that Seldon is a Healthcare based firm. So, what this shows is Embedded Finance, can benefit the Healthcare and the Pharmaceutical Industry. Telcos offer digital banking products, digital wallets, and digital payment cards. What this means is development in banking services can also improve payment services. So, industries benefiting from Embedded Banking, somewhat benefit from Embedded Payments too. Shopify offers Embedded Banking facilities by encouraging small business owners to set up separate bank accounts for their company, instead of using personal and savings accounts. What this means is any SMEs can have access to a bank account to better manage their finances, and a better financial statement to analyse business performance and cash flow. Therefore, any industry can benefit from this initiative.

From all five factors of Embedded Finance analysed, the last sentence addresses that any industry can benefit from Embedded Finance, depending on the aspect of Embedded Finance they choose. We also noted that Embedded Banking can support Embedded Payments. Since Embedded Finance has financial value and can benefit any industry, it can be suggested the market is worth more than the current value of the top 30 Financial Institutions as mentioned in figure 6. In particular, figure 7, summarizes that Embedded Payment has the strongest growth project of Embedded Finance in five years, from 2020 to 2025. The figure is supported by Relevant which adds further weight to the usefulness of the figure. What can we learn? We can learn payments is projected to grow most, and this can be attributed due to the fact any industries can benefit from Embedded Payments more than the other four factors of Embedded Finance, but what should lead to a higher projected value is due to the rise of e-commerce, post covid, much of what we discussed earlier, of which relies on Embedded Payments for an easier transaction. Now, that we have covered which industries can benefit from Embedded Finance, and overall market analysis, we next analyse the future of Embedded Finance to understand why there is real value in the market, that can be unlocked in the near future, basing the importance of the thesis in recommending investment in the Embedded Finance Market.

Figure 6: Embedded Finance market value compared to other industries, in the US

Source: Simon - Torrance

Figure 7: Which aspect of Embedded Finance is projected to grow the most

Source: Verified Payments

Current Trends In Embedded Finance

We discussed how industries can benefit from Embedded Payments, Embedded Lending, Embedded Investments, Embedded Insurance and Embedded Banking. Due to the facilities provided, consumers have demand for these, but we only analysed from a business aspect why the five factors of Embedded Finance are important. However, we somewhat analysed from a consumer perspective, so in this part of the thesis, we show how consumers, with some focus on business, need Embedded Finance. Through this aspect, we can determine the future of Embedded Finance.

To determine the current trends in Embedded Finance, we analyse five factors. The five factors are customer demand for integrated experiences, Fintech evolution, the rise of openness and trust in financial services, search for new revenue models, adoption of technological capabilities. The five factors have been provided by McKinsey, although they use six factors and that we made changes to consider five factors. For instance Card Payments, and Payments in our view can be categorised as one factor. Next, we begin our analysis.

1. Customer demand for integrated experiences

Embedded Finance offers enhanced customer experiences and bridges the gap between consumers and businesses when finance is a constraint. For instance, the Shopify payments service supports online transactions. Enhanced experiences are able due to the use of UX research which is further improvement through technology. What this means for the future of Embedded Finance is customer-focused solutions to financial problems. This has been seen as the case for Embedded Lending, Embedded Payments and Embedded Banking as explained earlier.

2. Fintech evolution

We can note that banks want to protect and grow their products including payment and loans, which can be facilitated through Embedded Finance. Banks also want to utilise Fintech products to their digital banking platforms. What this means is that we have witnessed a growing role of financial services to ordinary businesses and technology platforms. What this means for Embedded Finance, is banks and financial institutions adapting to Embedded Finance, which was already discussed earlier, and that we noted governments are investing in finance to support the transition to Embedded Finance, so this is a trend that is likely to continue into the future.

3. Rise of openness and trust in financial services

Embedded Finance creates infrastructure and tools to offer customer orientated digital platforms to allow customers to have sufficient information for making financial decisions. Banks and other Financial Institutions can offer better and cheaper financial services, which is important in developing countries as discussed earlier. More to the point, trust is building in financial services through more customised loans, for instance. What this means for Embedded Finance, globally as seen with the case of India, there is better relationships with banks and trust, which is important since after the 2008 financial crises consumers have questioned banks support of economic growth, and Embedded Finance seems to build the bridge between consumer trust in banks.

4. Search for new revenue models

Embedded Finance, can help online marketplaces or supply chains, and SMEs access financial products. Embedded Finance, encourages Fintech companies to help support the broader economy, so current challenges are the digitalisation of products and services, much of what we discussed earlier. Embedded Finance, helps businesses track customer behaviour, by building the infrastructure for a digital platform, so a digitalised revenue platform for businesses including SMEs to attract and retain existing customers. What this means, Embedded Finance can build the bridge between customer retention, and finding new customers, through online marketplaces.

5. Adoption of technological capabilities

Embedded Finance relies on new and advanced technological infrastructure, to provide the tools to help customers benefit from digitised banking services. The technologies are API driven that can be utilised in a variety of applications such as marketplaces or even Fintech application software. Technology includes a tool to provide analysis of a loan life cycle. Some events suggest banks adopting Fintech solutions, can acquire more data and to tailor more financial products, and will partner with technology companies. Even so, the role of AI in Finance will grow, to make use of Embedded Finance to offer tailored financial products and services, to improve customer experience. What this means is that there will be better Data, Analytics, and Technological software to support the role of Embedded Finance.

Touching Thoughts

Embedded Finance, can benefit the future of the digital world, particularly through e-commerce based on Embedded Payments, the most, as agreed in figure 7. With Fintech evolution focused on supporting Embedded Banking, and therefore Embedded Payments, this seems to be the future of Embedded Finance; ease in a transaction. What can be learnt is any industry can benefit from Embedded Finance, which is one of many reasons governments have grown a strong interest in Embedded Finance. Distinctly, Embedded Finance will grow since it supports an integrated experience for customers but creates openness and trust, which is important, as seen in the case of India where openness and trust can be solved by Embedded Finance. Thus it is a growing industry in India, so we should expect the same elsewhere. This leads us to our final judgement, to invest in startups operating in this industry, will most likely be a worthwhile venture.

More to the point, Fintech infrastructure is a crucial part of Embedded Finance, and as the paper was not focused on Fintech, alone, which supports Embedded Finance, we have not delved deep into Fintech infrastructure. Understanding Fintech infrastructure will help better understand the technological capability of Embedded Finance. Better understanding the technological ability will truly help convince us whether Embedded Finance has a strong future, as in today’s society, effective technology is important for any industry to grow and survive. So, we did not delve deep into Fintech infrastructure, as the thesis is focused on providing an analysis of the Embedded Finance industry as a whole, and not stick to focusing on Fintech only. So, in the near future, this can be an area that can be further investigated. On that note, to learn about Fintech infrastructure the report is recommended.

Exciting topic and fascinating article.

I think the potential of embedded finance to fund SMEs is underestimated (maybe because in volume it's much lower than payments or consumer lending?).

It could be an opportunity for factoring fintechs that are a bit stuck on a niche at the moment or leasing companies that are used to point-of-sale funding (provided they can totally digitised their processes). Trade finance too maybe.